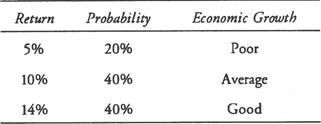

An analyst has estimated that the returns for an asset, conditional on the performance of the overall economy, are:

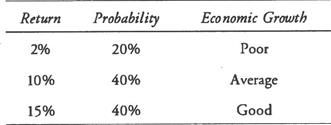

The conditional expected returns on the market portfolio are:

According to the CAPM, if the risk-free rate is 5% and the risky asset has a beta of 1, with respect to the market portfolio, the analyst should:

A.Sell (or sell short) the risky asset because its expected return is less than equilibrium expected return on the market portfolio.

B.Buy the risky asset because the analyst expects the return on it to be higher than its required return in equilibrium.

C.Sell (or sell short) the risky asset because its expected return is not sufficient to compensate for its systematic risk.

参考答案与解析:

-

相关试题

-

An asset has an annual return of 19.9%, standard deviation of returns of 18.5%, and correlation with

-

[单选题]An asset has an annual return of 19.9%, standard deviation of returns of 18

- 查看答案

-

Which of the following asset classes has historically had the highest returns and standard deviation

-

[单选题]Which of the following asset classes has historically had the highest retur

- 查看答案

-

The variance of returns of Asset A is 625. The variance of returns of Asset B is 1,225. The covarian

-

[单选题]The variance of returns of Asset A is 625. The variance of returns of Asset

- 查看答案

-

Using historical index returns for an equities market over a 20-year period, an analyst has calculat

-

[单选题]Using historical index returns for an equities market over a 20-year period

- 查看答案

-

An analyst is reviewing a company with a large deferred tax asset on its balance sheet. She has dete

-

[单选题]An analyst is reviewing a company with a large deferred tax asset on its ba

- 查看答案

-

An analyst compared the performance of a hedge fund index with the performance of a major stock inde

-

[单选题]An analyst compared the performance of a hedge fund index with the performa

- 查看答案

-

A portfolio is invested 30% in Asset A with the remainder invested in Asset B. Asset A has an expect

-

[单选题]A portfolio is invested 30% in Asset A with the remainder invested in Asset

- 查看答案

-

An analyst observes that the historic geometric returns are 9% for equities,3% for treasury bills, a

-

[单选题]An analyst observes that the historic geometric returns are 9% for equities

- 查看答案

-

An analyst is testing the hypothesis that the variance of monthly returns for Index L equals the var

-

[单选题]An analyst is testing the hypothesis that the variance of monthly returns f

- 查看答案

-

Fundamental Asset Managers claims compliance with the CFA Institute Global Investment Performance St

-

[单选题]Fundamental Asset Managers claims compliance with the CFA Institute Global

- 查看答案