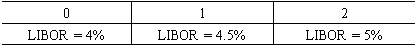

A U.S. bank enters into a plain vanilla currency swap with a notional principal of US$500 million (GBP£300 million). At each settlement date, the U.S. bank” pays a fixed rate of 4.5 percent on the British pounds received and the British bank pays a variable rate equal to LIBOR on the U.S. dollars received. Given the following information, what payment is made to whom at the end of year 2?

The U.S. bank pays:

A.US$13.50 million and the British bank pays 25.00 million.

B.£13.50 million and the British bank pays US$25.00 million.

C.£13.50 million and the British bank pays US$22.50 million.

参考答案与解析:

-

相关试题

-

A major bank has entered into a 4-year, annual-pay, 6% plain-vanilla interest rate swap with a notio

-

[单选题]A major bank has entered into a 4-year, annual-pay, 6% plain-vanilla intere

- 查看答案

-

A plain vanilla interest rate swap is a contract where one party pays a:

-

[单选题]A plain vanilla interest rate swap is a contract where one party pays a:A.F

- 查看答案

-

A company and its bank have entered into a currency swap in which the company pays USD to the bank.

-

[单选题]A company and its bank have entered into a currency swap in which the compa

- 查看答案

-

The monetary authority of The Stoddard Islands will exchange its currency for U.S. dollars at a one-

-

[单选题]The monetary authority of The Stoddard Islands will exchange its currency f

- 查看答案

-

Which of the following is least likely a tool used by the U.S. Federal Reserve Bank to directly infl

-

[单选题]Which of the following is least likely a tool used by the U.S. Federal Rese

- 查看答案

-

A Japanese exporter will sell U.S. dollars for Japanese Yen in the quote-driven currency markets. Wh

-

[单选题]A Japanese exporter will sell U.S. dollars for Japanese Yen in the quote-dr

- 查看答案

-

If a U.S. investor is forecasting that the yield spread between U.S. Treasury bonds and U.S. corpora

-

[单选题]If a U.S. investor is forecasting that the yield spread between U.S. Treasu

- 查看答案

-

A U.S. Treasury bill (T-bill) has 90 days to maturity and a bank discount yield of 3.25%. The effect

-

[单选题]A U.S. Treasury bill (T-bill) has 90 days to maturity and a bank discount y

- 查看答案

-

根据以下材料,回答题Every day 25 million U.S. children fideschool buses. The safety record for these buses is

-

[单选题]根据以下材料,回答题Every day 25 million U.S. children fideschool buses. The safety r

- 查看答案

-

根据以下材料,回答题Every day 25 million U.S. children fideschool buses. The safety record for these buses is

-

[单选题]根据以下材料,回答题Every day 25 million U.S. children fideschool buses. The safety r

- 查看答案