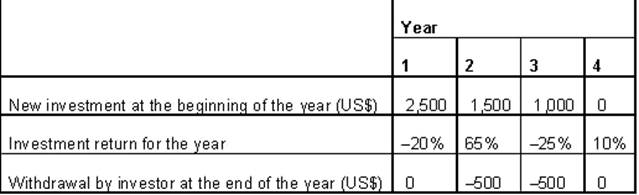

An investor's transaction in a mutual fund and the fund's returns over a four-year period are provided in the following table:

based on this data,the money-weighted return(or internal rate of return)for the investor is closest to:

A.7.50%

B.2.15%

C.3.96%

参考答案与解析:

-

相关试题

-

An investor's transactions in a mutual fund and the fund's returns over a four-year period

-

[单选题]An investor's transactions in a mutual fund and the fund's returns over a f

- 查看答案

-

Carlos Cruz, CFA, is one of two founders of an equity hedge fund. Cruz manages the fund's asset

-

[单选题]Carlos Cruz, CFA, is one of two founders of an equity hedge fund. Cruz mana

- 查看答案

-

Carlos Cruz, CFA, is one of two founders of an equity hedge fund. Cruz manages the fund's asset

-

[单选题]Carlos Cruz, CFA, is one of two founders of an equity hedge fund. Cruz mana

- 查看答案

-

Over a four-year period, a portfolio has returns of 10%, –2%, 18%, and –12%. The geometric mean retu

-

[单选题]Over a four-year period, a portfolio has returns of 10%, –2%, 18%, and –12%

- 查看答案

-

A country's year-end consumer price index over a 5-year period is as follows:<br />Year 1

-

[单选题]A country's year-end consumer price index over a 5-year period is as follow

- 查看答案

-

On 1 January 2009, an institutional investor's portfolio is valued at $10,000,000. The investor

-

[单选题]On 1 January 2009, an institutional investor's portfolio is valued at $10,0

- 查看答案

-

On 1 January 2009, the value of an investor's portfolio is $89,000. The investor plans to donat

-

[单选题]On 1 January 2009, the value of an investor's portfolio is $89,000. The inv

- 查看答案

-

The following information relates to an investor's positioning the futures market:<br />&

-

[单选题]The following information relates to an investor's positioning the futures

- 查看答案

-

Which of the following is most likely associated with an investor's ability to take risk rather

-

[单选题]Which of the following is most likely associated with an investor's ability

- 查看答案

-

The covariance of the market's returns with a stock's returns is 0.005 and the standard de

-

[单选题]The covariance of the market's returns with a stock's returns is 0.005 and

- 查看答案