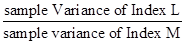

An analyst is testing the hypothesis that the variance of monthly returns for Index L equals the variance of monthly returns for Index M based on samples of 50 monthly observations. The sample variance of Index L returns is 0.085, whereas the sample variance of Index M returns is 0.084. Assuming the samples are independent and the returns are normally distributed, which of the following represents the most appropriate test statistic?

A.

B.

C.

参考答案与解析:

-

相关试题

-

An analyst gathered the following information about the monthly returns over the same time period fr

-

[单选题]An analyst gathered the following information about the monthly returns ove

- 查看答案

-

The variance of returns of Asset A is 625. The variance of returns of Asset B is 1,225. The covarian

-

[单选题]The variance of returns of Asset A is 625. The variance of returns of Asset

- 查看答案

-

Using historical index returns for an equities market over a 20-year period, an analyst has calculat

-

[单选题]Using historical index returns for an equities market over a 20-year period

- 查看答案

-

Which of the following statements about hypothesis testing is most accurate?

-

[单选题]Which of the following statements about hypothesis testing is most accurate

- 查看答案

-

Which of the following statements about hypothesis testing is least accurate?

-

[单选题]Which of the following statements about hypothesis testing is least accurat

- 查看答案

-

The appropriate test statistic to test the hypothesis that the variance of a normally distributed po

-

[单选题]The appropriate test statistic to test the hypothesis that the variance of

- 查看答案

-

Which of the following statements about hypothesis testing is most accurate?

-

[单选题]Which of the following statements about hypothesis testing ismost accurate?

- 查看答案

-

Survivorship bias in reported hedge fund index returns will most likely result in index:

-

[单选题]Survivorship bias in reported hedge fund index returns will most likely res

- 查看答案

-

The correlation between the historical returns of Stock A and Stock B is 0.75. If the variance of St

-

[单选题]The correlation between the historical returns of Stock A and Stock B is 0.

- 查看答案

-

The correlation between the historical returns of Stock A and Stock B is 0.75. If the variance of St

-

[单选题]The correlation between the historical returns of Stock A and Stock B is 0.

- 查看答案