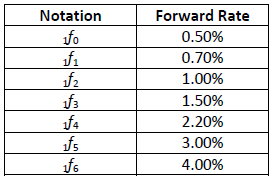

Assume the following six-month forward rates (presented on an annualized, bond-equivalent basis) were calculated from the yield curve.

The 3-year spot rate is closest to:

A.0.74%.

B.1.48%.

C.2.06%.

参考答案与解析:

-

相关试题

-

The bond-equivalent yield (BEY) spot rates for U.S. Treasury yields are provided below.<br />&

-

[单选题]The bond-equivalent yield (BEY) spot rates for U.S. Treasury yields are pro

- 查看答案

-

The bond-equivalent yield for a semi-annual pay bond is most likely:

-

[单选题]The bond-equivalent yield for a semi-annual pay bond is most likely:A.Moret

- 查看答案

-

If the yield to maturity on an annual-pay bond is 7.75%, the bond-equivalent yield is closest to:

-

[单选题]If the yield to maturity on an annual-pay bond is 7.75%, the bond-equivalen

- 查看答案

-

If the yield-to-maturity on an annual-pay bond is 7.75%, the bond-equivalent yield is closest to:

-

[单选题]If the yield-to-maturity on an annual-pay bond is 7.75%, the bond-equivalen

- 查看答案

-

Using the following US Treasury forward rates, the value of 2?-year $100 par value Treasury bond wit

-

[单选题]Using the following US Treasury forward rates, the value of 2?-year $100 pa

- 查看答案

-

Assume the following annual forward rates were calculated from the yield curve.<br /><img b

-

[单选题]Assume the following annual forward rates were calculated from the yield cu

- 查看答案

-

Using the following US Treasury/forward rates the value of a 21/2year $/00 par value Treasury/bond w

-

[单选题]Using the following US Treasury/forward rates the value of a 21/2year $/00

- 查看答案

-

An analyst gathered the following information about spot rates and a coupon bond (all rates are annu

-

[单选题]An analyst gathered the following information about spot rates and a coupon

- 查看答案

-

The six-month Treasury bill has a yield to maturity of 5 percent. The one-year Treasury bill with ze

-

[单选题]The six-month Treasury bill has a yield to maturity of 5 percent. The one-y

- 查看答案

-

Assume that the rates and allowances for

-

[试题]A.ssume that the rates and allowances for 2004/05 apply throughout this part.(b) Explain the consequences of filing the VAT returns late and advise Fred how he should deal with theunderpayment and bad debt for VAT purposes. Your explanation should be

- 查看答案