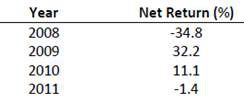

An asset management firm generated the following annual returns in their U.S. large cap equity portfolio:

The 2012 return needed to achieve a trailing five year geometric mean annualized return of 5.0% when calculated at the end of 2012 is closest to:

A.17.9%.

B.27.6%.

C.35.2%.

参考答案与解析:

-

相关试题

-

An asset management firm generated the following annual retums in their US large-cap equity portfoli

-

[单选题]An asset management firm generated the following annual retums in their US

- 查看答案

-

Rob Elliott, a CFA candidate, is an analyst with a large asset management firm. His personal portfol

-

[单选题]Rob Elliott, a CFA candidate, is an analyst with a large asset management f

- 查看答案

-

According to U.S. GAAP, an asset is impaired when:

-

[单选题]According to U.S. GAAP, an asset is impaired when:A.The firm cannot fully r

- 查看答案

-

A U.S. pulp brokerage firm which prepares its financial statements according to U.S. GAAP and uses a

-

[单选题]A U.S. pulp brokerage firm which prepares its financial statements accordin

- 查看答案

-

Florence Zuelekha, CFA, is an equity portfolio manager at Grid Equity Management (GEM), a firm speci

-

[单选题]Florence Zuelekha, CFA, is an equity portfolio manager at Grid Equity Manag

- 查看答案

-

An asset has an annual return of 19.9%, standard deviation of returns of 18.5%, and correlation with

-

[单选题]An asset has an annual return of 19.9%, standard deviation of returns of 18

- 查看答案

-

Which of the following statements is least accurate? A firm's free cash flow to equity (FCFE):

-

[单选题]Which of the following statements is least accurate? A firm's free cash flo

- 查看答案

-

Which of the following changes in a firm's working capital management is most likely to result

-

[单选题]Which of the following changes in a firm's working capital management is mo

- 查看答案

-

Which of the following statements is least accurate? A firm's free-cash-flow-to-equity (FCFE):

-

[单选题]Which of the following statements is least accurate? A firm's free-cash-flo

- 查看答案

-

Use the following data to answer Questions 54 and 55.<br /> The annual returns for FJW's

-

[单选题]Use the following data to answer Questions 54 and 55. The annual returns f

- 查看答案