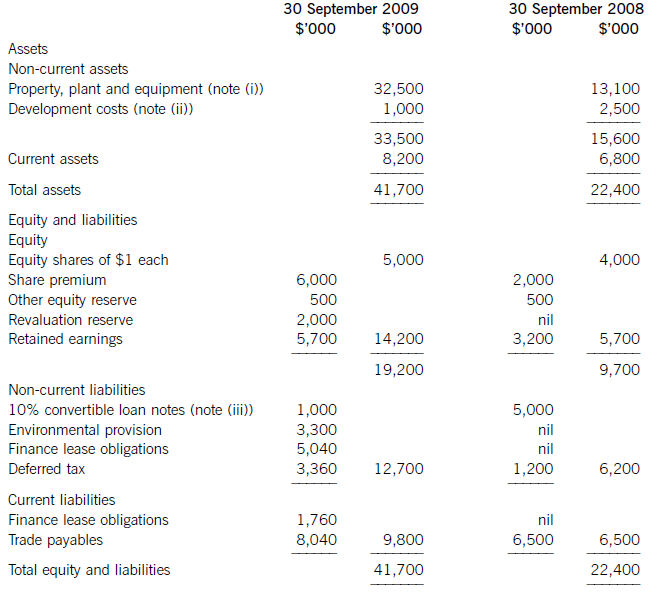

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

A.lso on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

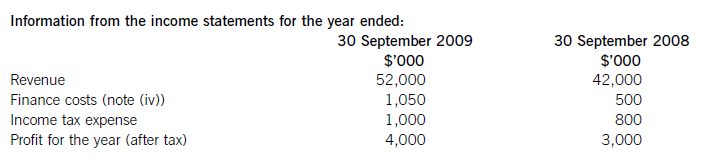

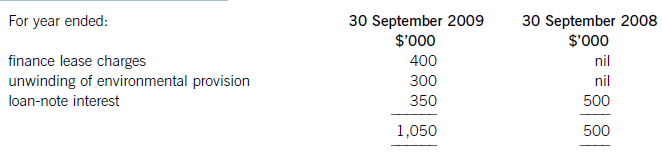

A.ll the above items have been treated correctly according to International Financial Reporting Standards.(iv) The finance costs are made up of:

Required:(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

C.alculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

参考答案与解析:

-

相关试题

-

The following information relates to an investor's positioning the futures market:<br />&

-

[单选题]The following information relates to an investor's positioning the futures

- 查看答案

-

The following information relates to a futures market contract:<br /><img border="0&qu

-

[单选题]The following information relates to a futures market contract:If no funds

- 查看答案

-

The following trial balance relates to S

-

[主观题]The following trial balance relates to Sandown at 30 September 2009:The following notes are relevant:(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing ser

- 查看答案

-

Which of the following statements most closely relates to the concept of moneyness?

-

[单选题]Which of the following statements most closely relates to the concept of mo

- 查看答案

-

Which of the following information is No

-

[单选题]Which of the following information is NoTmedtioned?A.Who wrote the stories. B.Which story is the longest.C.When we added the stories. D.Who added the stories.

- 查看答案

-

The following information is available f

-

[单选题]The following information is available for a manufacturing company which produces multiple products:(i) The product mix ratio(ii) Contribution to sales ratio for each product(iii) General fixed costs(iv) Method of apportioning general fixed costsWhic

- 查看答案

-

11 The following information is availabl

-

[单选题]11 The following information is available for Orset, a sole trader who does not keep full accounting records:$Inventory 1 July 2004 138,60030 June 2005 149,100Purchases for year ended 30 June 2005 716,100Orset makes a standard gross profit of 30 per

- 查看答案

-

The following information is relevant fo

-

[单选题]The following information is relevant for questions 9 and 10A. company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,and a suspense account appeared in the company’s draft balance sheet.Su

- 查看答案

-

The following financial information rela

-

[试题]The following financial information relates to HGR Co:Statement of financial position at the current date (extracts)The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure i

- 查看答案

-

The following relates to a company's common ecluity over the course of the year:<br /><

-

[单选题]The following relates to a company's common ecluity over the course of the

- 查看答案